Registrations

Bringing business ideas alive

Make Your Business A Tangible Force

Every business is born from an idea. An idea that aims to provide something different, something unique. A monetizable solution to a problem that people are willing to pay for. But only a few business ideas make it past the first phase – Becoming real.

Over 99% of business ideas never get past that barrier. But if you’ve made it this far, you are in that 1% willing to take the next step and move forward.

Registrations are a core part of what we do here at Mukunda Shiva and Associates. Businesses come in all shapes and sizes. From sole proprietorships to Private Limited Companies. But they’re all made official after registration.

But registrations are not as simple as they might seem. Based on the type of business, its nature, scale, purpose, impact and many other factors, the clauses and requirements associated with the registration of different types of businesses are highly unique.

That’s where we come in. Instead of having to worry about what paperwork you need to file, what permissions you need and other blockers, all you need to worry about is what you need to do to make your business work. Leave the complex procedures to us. We’ve been doing it for 19 years and we can seamlessly take care of it for you.

Here you go to check your Suitable format

Sole Proprietorship

It’s all you. A sole proprietorship is ideal for those who want the organisation to be under just one person. That means that the business and the owner are one and the same and aren’t separate entities.

Advantages

- Ownership is solely owned by an Individual and no conflicts

- Business owner has a power to control the business operations.

- Owner will receive all the profits and bear all the losses.

- Easy to setup

Disadvantages

- Owners and business are referred to as one of the same entities (no separation)

- Cannot add another founder in business

- Unlimited Liability

- No synergy

Partnership Firm

If two or more people want to come together and start a business, getting yourself registered as a partnership firm under Indian Partnership Act, 1932 would be ideal. 10 partners is the upper limit for a banking firm, but for others, the limit is 20.

Advantages

- Two or more individuals share cost & responsibilities

- Terms of partnership recorded in partnership agreement

- “Silent partner” concept is possible

- Easy to setup

- Synergy is high

- Share of profit is possible without being subject to tax

Disadvantages

- Liable for the action of another partner

- Unlimited liability

- Benefit of slab rate taxation is not possible

Limited Liability Partnership

LLPs or Limited Liability Partnerships are entities separate from the owners. It’s a hybrid organization that falls somewhere between a partnership firm and a company. It is an attractive option due to limited liability and the flexibility of organizing internal affairs as a partnership based on a mutually arrived agreement.

Advantages

- Two or more individuals share cost & responsibilities

- Terms of partnership recorded in partnership agreement

- “Silent partner” concept is possible

- Easy to setup

- Synergy is high

- Share of profit is possible without being subject to tax

Private Limited Company

Get Registered under the Company’s Act 2013. Ideal for small or medium businesses wherein the liability of a member is limited to the shares held by them.

Advantages

- A separate legal entity

- A company is ruled by its charter documents of MOA & AOA

- Those who buy shares are Shareholders

- Board of Directors runs the corporation

- Brand Protection

- Aids long Term Planning

- Looser Corporate Governance

- Shareholders have limited liability, not responsible for debts.

- Preferred structure to bring in more and more investments

Disadvantages

- Double taxation on Net profit if distributed as Dividend

- Various restrictions like taking loan or giving loan from unrelated person is prohibited

- Regular and annual filings with MCA applicable

- Winding up is not easy. Shares cannot be quoted in Stock Exchange

Public Limited Company

With a public limited company, you can acquire share capital from the general public in large scale. This is ideal for mega corporations with big operations and objectives. Liability here is limited to the shares owned by a member.

Advantages

- Raising capital through public issue of shares

- Other Finance opportunities

- Growth & expansion opportunities

- Prestigious profile & confidence

- Shares are more easily transferable

Disadvantages

- Compliance costs are very high

- More vulnerable to a hostile takeover if a majority of shareholders agree to a bid

- Initial financial commitment is higher

- Ownership & control issues

- Not suitable for smaller organizations

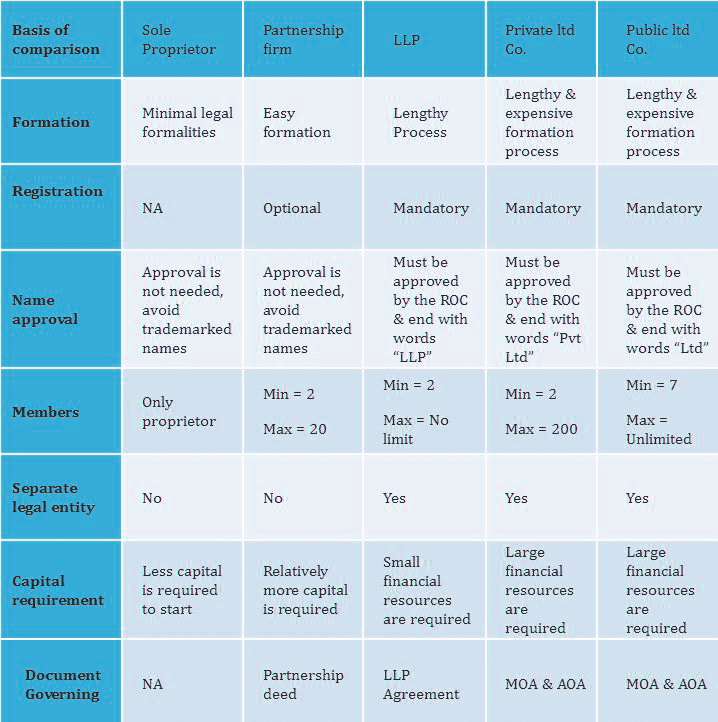

Compare Your Options

Basis Your Requirement, we will help you to set up company in the

chosen format

GST Registration

GST stands for Goods and Services Tax. GST or Goods and Services Tax is an indirect taxation system in India. It was started in India in 2017 with several purposes.

GST Registration is basically an application form to register under GST. Every business as per the eligibility criteria has to get GST Registration and formerly submit taxes through GST Return Filing .

Advantages

- GST reduces the number of Indirect Taxes.

- The GST Registration is completely online.

- The number of GST Compliances is less so you don’t have to invest a lot of time for GST Return Filing.

- Ease of doing inter-state business using e-commerce operators after getting GST Registration in India.

- GST has regularized unorganized business sectors in India through online procedures.

- It provides a single GSTIN that can be used for all the aspects of GST.

- It offers a composition scheme to pay taxes at a fixed rate and reduce the tax liability and tax rates..

- The threshold limit of GST Registration is quite high i.e. Rs. forty lakhs annual turnover or Rs. twenty lakhs annual turnover for special states under GST.

- You can claim Input Tax Credit easily after fulfilling the compliances.

- It is easy to detect tax evasion under GST Registration.

Disadvantages

- The GST has increased the business operational costs.

- Late GST Return Filing can result in penalties. You can use Tax Panchang to remind yourself of the due dates of all the tax compliances.

- The GST Regime is strict and without filing a GST Return you can not generate e-way bills. Thus, you can not transport your products inter-state without enrolling under GST and filing returns on time.

- Multiple businesses find it cumbersome to maintain online records, generate invoices, etc.

- It is still difficult for businesses in remote areas to enroll under GST.

- It has increased the burden of compliances.

PAN and TAN Registration

The easiest way to get your Personal Identification Number (PAN) or Tax Deduction and Collection Account Number (TAN) is by getting it done with our help. Our dedicated branch has processed and delivered hundreds of PAN and TAN registrations and we can deliver it to you with 0 hassles. You are eligible for TAN if you need to deduct tax at source for payments like rent, salaries or payments to contractors or are a business branch or non-profit that’s making payments above a certain limit.

MSME Registration

An enterprise shall be classified as a micro, small or medium enterprise on the basis of the following criteria, namely:

- a micro enterprise, where the investment in plant and machinery or equipment does not exceed one crore rupees and turnover does not exceed five crore rupees;

- a small enterprise, where the investment in plant and machinery or equipment does not exceed ten crore rupees and turnover does not exceed fifty crore rupees; and

- a medium enterprise, where the investment in plant and machinery or equipment does not exceed fifty crore rupees and turnover does not exceed two hundred and fifty crore rupees.

S & E Registration

The Karnataka Shops and Establishment Act regulates the operations of shops and commercial establishments. The Karnataka Shops and Establishment Act was introduced to regulate the hours of work, annual leave with wages, wages and compensation, employment of women and children and other aspects of shops or commercial establishment.

Trade License

Trade license is a permit issued by a municipal corporation granting permission to a person or entity to carry particular business at a specific premise. It ensures that the citizens are not adversely affected by health hazards and perils brought forth by the improper conduct of trade. It is a system that also ensures the manner of business pursued by a company is following the specified rules, safety guidelines and standards.

Registration under various statutes

Factory License, FSSAI, Trade Mark License, Trust Registration, Association Registration, GEM Registration, ICEGATE, Society Registration, FRRO, PT, PF, ESI etc..